Description

A Return Material Authorization (RMA) or Sales Return is the process of a seller accepting a purchased item back from the consumer. In turn, the customer receives credit, cash refund or a replacement

In this post discussed how the GST would be applicable while doing the Return material authorization in order management in oracle EBS R12

Responsibility: India Local Order Management.

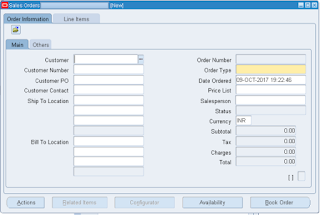

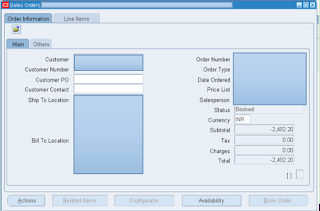

Step1.Navigation: Oracle Order Management > Orders, Returns > Sales Order.

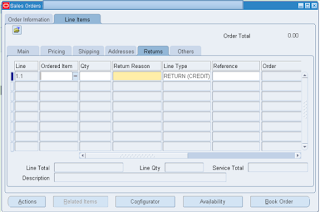

Step 2:Click on Line Items and define the Return reason

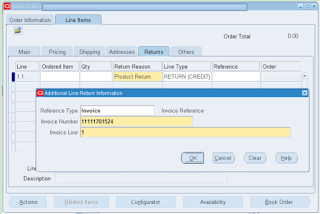

Provide the Reference Type : Invoice

Provide Invoice Number

Provide Invoice Line

Click Ok.

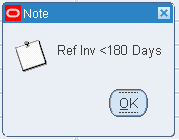

Click ok.

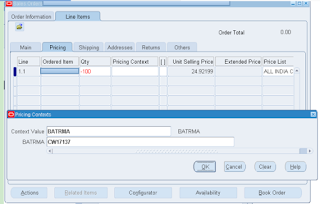

Go to Pricing tab and click on DFF.

Select BATRMA

BATRMA Select the Batch.

Click ok.

Save.

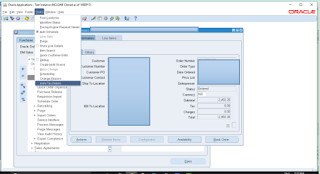

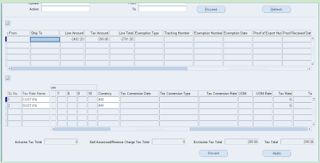

Click on Order Information Tab and click on Tools > India Tax Details.

Click on Apply.

Save.

Click on Book order.

Click Ok.

Take the Receipts.

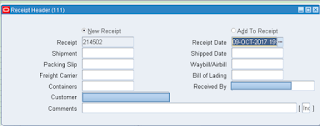

Step 3:Responsibility: India Local Inventory.

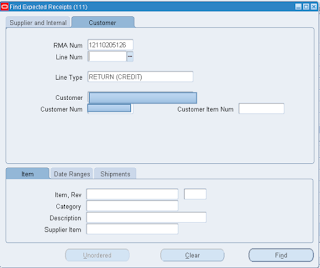

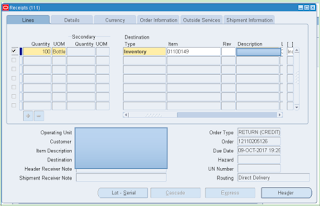

Navigation: Oracle Inventory > Transactions > Receipts > Receipts

Select Customer Tab.

Provide the RMA No:

Click Find

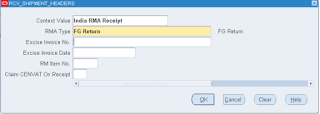

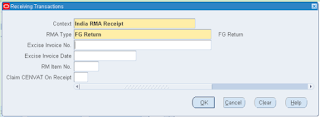

Click on DFF, Select the India RMA Receipt

Click ok

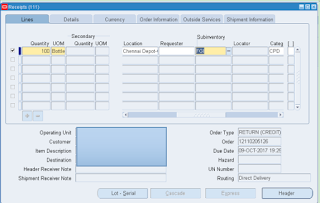

Select the line and provide Sub Inventory.

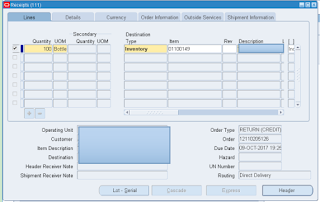

Click the DFF

Click ok

Click ok

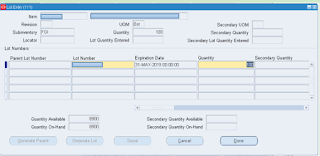

Click on Lot – Serial.

Click Done

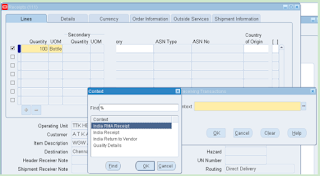

Go to Tools > India Tax Details.

Save

Save.

Click on header

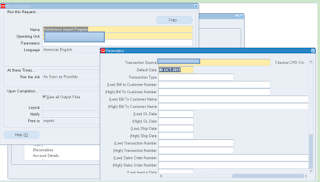

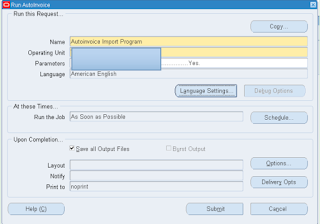

Step 4: Run Auto Invoice.

Click ok

Click Submit.

Go to order Management responsibility and open Sales Order screen.

Query for RMA.

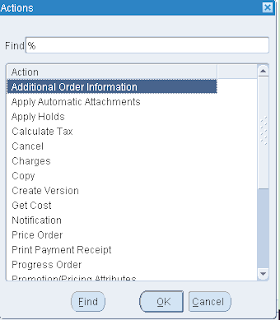

Click on Actions

Select Additional Order Information.

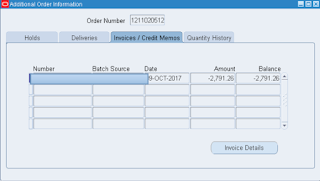

Click on Invoices and take the Transaction Number.

1211700010

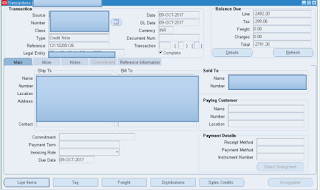

After Create Accounting.

View Accounting.

Take the Receipt Number.

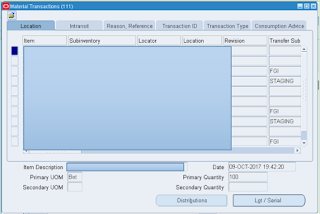

Material Transactions Screen

Click on Distributions Tab.

Journal Entry for Base Amount.

Queries?

Do drop a note by writing us at doyen.ebiz@gmail.com or use the comment section below to ask your questions